This page was generated from a Jupyter notebook. You can view it on GitHub or download and run it locally.

S&P 500 Stocks Multivariate Empirical Study

This notebook compares multivariate probability distributions for modeling S&P 500 stock returns. The main purpose is to test the EM algorithm in real-world high-dimensional settings.

Distributions Compared

Multivariate Normal - Baseline Gaussian distribution

Variance Gamma (VG) - Normal-Gamma mixture, semi-heavy tails

Normal Inverse Gamma (NInvG) - Normal-InverseGamma mixture, heavy tails

Normal Inverse Gaussian (NIG) - Normal-InverseGaussian mixture

Generalized Hyperbolic (GH) - Most general, encompasses VG, NInvG, NIG as special cases

Methodology

Data: 10 years of S&P 500 constituent stocks daily returns

Training: First 5 years (in-sample)

Testing: Last 5 years (out-of-sample)

EM Algorithm: Track convergence and timing in high dimensions

Testing Methods: Random portfolio projections, KS/AD tests, QQ plots

Parameter Analysis: Compare location (μ) vs skewness (γ) parameters across stocks

[1]:

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

from matplotlib.gridspec import GridSpec

from scipy import stats

from scipy.stats import ks_2samp, anderson_ksamp

import warnings

import time

warnings.filterwarnings('ignore')

# Import normix distributions

from normix.distributions.multivariate import MultivariateNormal

from normix.distributions.mixtures import (

VarianceGamma, NormalInverseGamma, NormalInverseGaussian, GeneralizedHyperbolic

)

plt.style.use('seaborn-v0_8-whitegrid')

%matplotlib inline

print("Imports successful!")

Imports successful!

1. Load S&P 500 Stock Returns Data

The log returns data is pre-computed and stored in data/sp500_returns.csv. This file is generated by scripts/download_sp500_data.py which fetches S&P 500 constituent stocks from Wikipedia and downloads historical price data from Yahoo Finance.

[2]:

# Load pre-computed log returns from CSV

import os

data_path = '../data/sp500_returns.csv'

if not os.path.exists(data_path):

raise FileNotFoundError(

f"Data file not found at {data_path}. "

"Please run 'python scripts/download_sp500_data.py' first to generate the data."

)

log_returns = pd.read_csv(data_path, index_col='Date', parse_dates=True)

print(f"Loaded log returns from: {data_path}")

print(f"Shape: {log_returns.shape}")

print(f"Date range: {log_returns.index[0].date()} to {log_returns.index[-1].date()}")

print(f"Number of stocks: {len(log_returns.columns)}")

print(f"First 10 tickers: {list(log_returns.columns[:10])}")

Loaded log returns from: ../data/sp500_returns.csv

Shape: (2551, 224)

Date range: 2015-12-10 to 2026-02-03

Number of stocks: 224

First 10 tickers: ['A', 'AAPL', 'ABBV', 'ABT', 'ACN', 'ADBE', 'ADI', 'AEP', 'AES', 'AIG']

[3]:

# Use ALL stocks from the CSV file (no filtering needed - data is already clean)

# Note: High-dimensional fitting can be slow - adjust MAX_STOCKS if needed for computational constraints

MAX_STOCKS = None # Set to a number (e.g., 100) to limit, or None for all available stocks

# Select all stocks, sorted alphabetically

all_tickers = sorted(log_returns.columns.tolist())

if MAX_STOCKS is not None and MAX_STOCKS < len(all_tickers):

selected_tickers = all_tickers[:MAX_STOCKS]

print(f"Limited to {MAX_STOCKS} stocks for computational efficiency")

else:

selected_tickers = all_tickers

log_returns_selected = log_returns[selected_tickers]

print(f"Selected {len(selected_tickers)} stocks for analysis:")

print(f"Tickers: {selected_tickers[:20]}{'...' if len(selected_tickers) > 20 else ''}")

Selected 224 stocks for analysis:

Tickers: ['A', 'AAPL', 'ABBV', 'ABT', 'ACN', 'ADBE', 'ADI', 'AEP', 'AES', 'AIG', 'ALL', 'AMAT', 'AMD', 'AMGN', 'AMT', 'AMZN', 'APA', 'APD', 'ARE', 'AVB']...

[4]:

# Split into training (first half) and testing (second half)

n_total = len(log_returns_selected)

n_train = n_total // 2

train_df = log_returns_selected.iloc[:n_train]

test_df = log_returns_selected.iloc[n_train:]

# Convert to numpy arrays

returns_train = train_df.values

returns_test = test_df.values

print(f"\nTraining period: {train_df.index[0].date()} to {train_df.index[-1].date()}")

print(f"Training samples: {returns_train.shape[0]}, dimensions: {returns_train.shape[1]}")

print(f"\nTesting period: {test_df.index[0].date()} to {test_df.index[-1].date()}")

print(f"Testing samples: {returns_test.shape[0]}, dimensions: {returns_test.shape[1]}")

Training period: 2015-12-10 to 2021-01-04

Training samples: 1275, dimensions: 224

Testing period: 2021-01-05 to 2026-02-03

Testing samples: 1276, dimensions: 224

[5]:

# Display training data statistics

print("--- Training Data Statistics ---")

mean_returns = returns_train.mean(axis=0) * 100

std_returns = returns_train.std(axis=0) * 100

skewness = stats.skew(returns_train, axis=0)

kurtosis = stats.kurtosis(returns_train, axis=0)

stats_df = pd.DataFrame({

'Mean (%)': mean_returns,

'Std (%)': std_returns,

'Skewness': skewness,

'Kurtosis': kurtosis

}, index=selected_tickers)

print(stats_df.round(4))

print(f"\n--- Summary ---")

print(f"Average mean return: {mean_returns.mean():.4f}%")

print(f"Average volatility: {std_returns.mean():.4f}%")

print(f"Average skewness: {skewness.mean():.4f}")

print(f"Average excess kurtosis: {kurtosis.mean():.4f}")

--- Training Data Statistics ---

Mean (%) Std (%) Skewness Kurtosis

A 0.0872 1.6669 -0.6919 7.1136

AAPL 0.1236 1.8991 -0.3552 7.4072

ABBV 0.0669 1.8452 -1.0039 14.5807

ABT 0.0772 1.5974 -0.3903 7.7395

ACN 0.0751 1.5903 -0.0063 8.8244

... ... ... ... ...

WMB -0.0040 3.1997 -1.8227 39.9337

WMT 0.0801 1.3877 0.7979 15.6157

XEL 0.0612 1.4044 -1.0123 19.8592

XOM -0.0285 1.8035 -0.1616 10.5633

ZBH 0.0368 1.8834 -0.1455 12.3800

[224 rows x 4 columns]

--- Summary ---

Average mean return: 0.0523%

Average volatility: 1.9748%

Average skewness: -0.5328

Average excess kurtosis: 17.8969

2. Fit Distributions with EM Algorithm Tracking

[6]:

# Storage for fitted distributions and convergence info

fitted_dists = {}

fitting_times = {}

convergence_history = {}

d = returns_train.shape[1] # dimension

print(f"Fitting distributions to {d}-dimensional data...")

Fitting distributions to 224-dimensional data...

2.1 Multivariate Normal (Baseline)

[7]:

print("Fitting Multivariate Normal...")

start_time = time.time()

mvn = MultivariateNormal(d=d).fit(returns_train)

fitting_times['MVN'] = time.time() - start_time

fitted_dists['MVN'] = mvn

print(f"Fitting time: {fitting_times['MVN']:.2f}s")

print(f"Mean log-likelihood (train): {np.mean(mvn.logpdf(returns_train)):.4f}")

print(f"Mean log-likelihood (test): {np.mean(mvn.logpdf(returns_test)):.4f}")

Fitting Multivariate Normal...

Fitting time: 0.08s

Mean log-likelihood (train): 702.2173

Mean log-likelihood (test): 624.0910

2.2 Variance Gamma (VG)

[8]:

print("Fitting Variance Gamma...")

start_time = time.time()

# Create a custom verbose fit to track convergence

vg = VarianceGamma()

vg_ll_history = []

# We'll manually track convergence by fitting with verbose=2

# and capturing the output, or by modifying the fit loop

# For simplicity, just fit with verbose

vg.fit(returns_train, max_iter=100, tol=1e-3, verbose=1)

fitting_times['VG'] = time.time() - start_time

fitted_dists['VG'] = vg

print(f"\nFitting time: {fitting_times['VG']:.2f}s")

print(f"Mean log-likelihood (train): {np.mean(vg.logpdf(returns_train)):.4f}")

print(f"Mean log-likelihood (test): {np.mean(vg.logpdf(returns_test)):.4f}")

Fitting Variance Gamma...

Initial log-likelihood: 445.622318

Iteration 1: log-likelihood = 702.301546

Iteration 2: log-likelihood = 712.297042

Iteration 3: log-likelihood = 718.818670

Iteration 4: log-likelihood = 720.217824

Iteration 5: log-likelihood = 720.394836

Iteration 6: log-likelihood = 720.414506

Iteration 7: log-likelihood = 720.416618

Iteration 8: log-likelihood = 720.416843

Iteration 9: log-likelihood = 720.416867

Iteration 10: log-likelihood = 720.416869

Converged at iteration 10

Final log-likelihood: 720.416869

Fitting time: 2.68s

Mean log-likelihood (train): 720.4169

Mean log-likelihood (test): 666.1294

2.3 Normal Inverse Gamma (NInvG)

[9]:

print("Fitting Normal Inverse Gamma...")

start_time = time.time()

ninvg = NormalInverseGamma()

ninvg.fit(returns_train, max_iter=100, tol=1e-3, verbose=1)

fitting_times['NInvG'] = time.time() - start_time

fitted_dists['NInvG'] = ninvg

print(f"\nFitting time: {fitting_times['NInvG']:.2f}s")

print(f"Mean log-likelihood (train): {np.mean(ninvg.logpdf(returns_train)):.4f}")

print(f"Mean log-likelihood (test): {np.mean(ninvg.logpdf(returns_test)):.4f}")

Fitting Normal Inverse Gamma...

Initial log-likelihood: 667.849344

Iteration 1: log-likelihood = 714.870073

Iteration 2: log-likelihood = 720.056497

Iteration 3: log-likelihood = 720.590019

Iteration 4: log-likelihood = 720.629384

Iteration 5: log-likelihood = 720.632118

Iteration 6: log-likelihood = 720.632313

Iteration 7: log-likelihood = 720.632327

Iteration 8: log-likelihood = 720.632328

Converged at iteration 8

Final log-likelihood: 720.632328

Fitting time: 0.21s

Mean log-likelihood (train): 720.6323

Mean log-likelihood (test): 666.0525

2.4 Normal Inverse Gaussian (NIG)

[10]:

print("Fitting Normal Inverse Gaussian...")

start_time = time.time()

nig = NormalInverseGaussian()

nig.fit(returns_train, max_iter=100, tol=1e-3, verbose=1)

fitting_times['NIG'] = time.time() - start_time

fitted_dists['NIG'] = nig

print(f"\nFitting time: {fitting_times['NIG']:.2f}s")

print(f"Mean log-likelihood (train): {np.mean(nig.logpdf(returns_train)):.4f}")

print(f"Mean log-likelihood (test): {np.mean(nig.logpdf(returns_test)):.4f}")

Fitting Normal Inverse Gaussian...

Initial log-likelihood: 529.719043

Iteration 1: log-likelihood = 706.340524

Iteration 2: log-likelihood = 718.128162

Iteration 3: log-likelihood = 720.312762

Iteration 4: log-likelihood = 720.540481

Iteration 5: log-likelihood = 720.560807

Iteration 6: log-likelihood = 720.562597

Iteration 7: log-likelihood = 720.562757

Iteration 8: log-likelihood = 720.562771

Iteration 9: log-likelihood = 720.562772

Converged at iteration 9

Final log-likelihood: 720.562772

Fitting time: 2.48s

Mean log-likelihood (train): 720.5628

Mean log-likelihood (test): 666.1407

2.5 Generalized Hyperbolic (GH)

[11]:

print("Fitting Generalized Hyperbolic...")

print("This is the most general model and may take longer...")

start_time = time.time()

gh = GeneralizedHyperbolic()

gh.fit(returns_train, max_iter=100, tol=1e-3, verbose=1, regularization='det_sigma_one')

fitting_times['GH'] = time.time() - start_time

fitted_dists['GH'] = gh

print(f"\nFitting time: {fitting_times['GH']:.2f}s")

print(f"Mean log-likelihood (train): {np.mean(gh.logpdf(returns_train)):.4f}")

print(f"Mean log-likelihood (test): {np.mean(gh.logpdf(returns_test)):.4f}")

Fitting Generalized Hyperbolic...

This is the most general model and may take longer...

Initial log-likelihood: 720.560807

Iteration 1: log-likelihood = 720.562228

Iteration 2: log-likelihood = 720.562318

Iteration 3: log-likelihood = 720.562324

Iteration 4: log-likelihood = 720.562325

Converged

Fitting time: 3.60s

Mean log-likelihood (train): 720.5623

Mean log-likelihood (test): 666.1362

3. Summary of Fitting Results

[12]:

# Compute log-likelihoods for all distributions

results = []

for name, dist in fitted_dists.items():

train_ll = np.mean(dist.logpdf(returns_train))

test_ll = np.mean(dist.logpdf(returns_test))

results.append({

'Distribution': name,

'Train LL': train_ll,

'Test LL': test_ll,

'Fitting Time (s)': fitting_times[name]

})

results_df = pd.DataFrame(results)

results_df = results_df.sort_values('Test LL', ascending=False)

print("\n" + "="*70)

print("SUMMARY: Distribution Fitting Results")

print("="*70)

print(results_df.to_string(index=False))

print("="*70)

======================================================================

SUMMARY: Distribution Fitting Results

======================================================================

Distribution Train LL Test LL Fitting Time (s)

NIG 720.562772 666.140655 2.481778

GH 720.562325 666.136179 3.599135

VG 720.416869 666.129448 2.676722

NInvG 720.632328 666.052491 0.207242

MVN 702.217252 624.090997 0.076318

======================================================================

[13]:

# Visualization of fitting times and log-likelihoods

fig, axes = plt.subplots(1, 3, figsize=(15, 5))

dist_names = list(fitted_dists.keys())

colors = plt.cm.Set2(np.linspace(0, 1, len(dist_names)))

# Plot 1: Fitting times

ax1 = axes[0]

times = [fitting_times[n] for n in dist_names]

bars1 = ax1.bar(dist_names, times, color=colors)

ax1.set_ylabel('Time (seconds)')

ax1.set_title('Fitting Time')

ax1.tick_params(axis='x', rotation=45)

# Add value labels

for bar, t in zip(bars1, times):

ax1.text(bar.get_x() + bar.get_width()/2, bar.get_height() + 0.5,

f'{t:.1f}s', ha='center', va='bottom', fontsize=9)

# Plot 2: Train log-likelihood

ax2 = axes[1]

train_lls = [np.mean(fitted_dists[n].logpdf(returns_train)) for n in dist_names]

bars2 = ax2.bar(dist_names, train_lls, color=colors)

ax2.set_ylabel('Mean Log-Likelihood')

ax2.set_title('Training Log-Likelihood')

ax2.tick_params(axis='x', rotation=45)

# Plot 3: Test log-likelihood

ax3 = axes[2]

test_lls = [np.mean(fitted_dists[n].logpdf(returns_test)) for n in dist_names]

bars3 = ax3.bar(dist_names, test_lls, color=colors)

ax3.set_ylabel('Mean Log-Likelihood')

ax3.set_title('Test Log-Likelihood (Out-of-Sample)')

ax3.tick_params(axis='x', rotation=45)

plt.tight_layout()

plt.savefig('fitting_summary.png', dpi=150, bbox_inches='tight')

plt.show()

4. Random Portfolio Projections Testing

To test multivariate distributions, we use random portfolio projections:

Generate random weight vectors

Project returns onto 1D using these weights

Compare simulated samples from fitted distributions vs actual test data

Use KS and Anderson-Darling tests

[14]:

def generate_random_weights(d, n_portfolios=100, random_state=None):

"""

Generate random portfolio weights.

Parameters

----------

d : int

Number of assets.

n_portfolios : int

Number of random portfolios to generate.

random_state : int, optional

Random seed.

Returns

-------

weights : ndarray

Shape (n_portfolios, d), each row sums to 1.

"""

rng = np.random.default_rng(random_state)

# Generate random weights from Dirichlet distribution (uniform on simplex)

# This ensures weights are positive and sum to 1

weights = rng.dirichlet(np.ones(d), size=n_portfolios)

return weights

def project_returns(returns, weights):

"""

Project multivariate returns to 1D portfolio returns.

Parameters

----------

returns : ndarray

Shape (n_samples, d).

weights : ndarray

Shape (n_portfolios, d) or (d,).

Returns

-------

portfolio_returns : ndarray

Shape (n_samples, n_portfolios) or (n_samples,).

"""

if weights.ndim == 1:

return returns @ weights

else:

return returns @ weights.T

[15]:

# Generate random portfolios

N_PORTFOLIOS = 100

random_weights = generate_random_weights(d, n_portfolios=N_PORTFOLIOS, random_state=42)

print(f"Generated {N_PORTFOLIOS} random portfolios")

print(f"Weight matrix shape: {random_weights.shape}")

print(f"First portfolio weights: {random_weights[0][:5].round(3)}...")

Generated 100 random portfolios

Weight matrix shape: (100, 224)

First portfolio weights: [0.011 0.011 0.011 0.001 0. ]...

[16]:

def portfolio_test(dist, returns_test, weights, n_samples=10000, random_state=None):

"""

Test a distribution using random portfolio projections.

Parameters

----------

dist : distribution object

Fitted distribution.

returns_test : ndarray

Test data, shape (n_test, d).

weights : ndarray

Portfolio weights, shape (n_portfolios, d).

n_samples : int

Number of samples to generate from distribution.

random_state : int, optional

Random seed.

Returns

-------

results : dict

Dictionary with KS and AD test statistics.

"""

# Generate samples from fitted distribution

samples = dist.rvs(size=n_samples, random_state=random_state)

n_portfolios = weights.shape[0]

ks_stats = []

ks_pvals = []

ad_stats = []

for i in range(n_portfolios):

w = weights[i]

# Project to 1D

test_proj = returns_test @ w

sample_proj = samples @ w

# KS test

ks_stat, ks_pval = ks_2samp(test_proj, sample_proj)

ks_stats.append(ks_stat)

ks_pvals.append(ks_pval)

# Anderson-Darling test (two-sample)

try:

ad_result = anderson_ksamp([test_proj, sample_proj])

ad_stats.append(ad_result.statistic)

except Exception:

ad_stats.append(np.nan)

return {

'ks_stats': np.array(ks_stats),

'ks_pvals': np.array(ks_pvals),

'ad_stats': np.array(ad_stats),

'ks_mean': np.mean(ks_stats),

'ks_median': np.median(ks_stats),

'ad_mean': np.nanmean(ad_stats),

'ad_median': np.nanmedian(ad_stats),

'ks_reject_rate': np.mean(np.array(ks_pvals) < 0.05) # Rejection rate at 5%

}

[17]:

# Run portfolio tests for all distributions

portfolio_results = {}

print("Running portfolio projection tests...")

print(f"Testing with {N_PORTFOLIOS} random portfolios\n")

for name, dist in fitted_dists.items():

print(f"Testing {name}...")

try:

results = portfolio_test(dist, returns_test, random_weights,

n_samples=5000, random_state=42)

portfolio_results[name] = results

print(f" KS mean: {results['ks_mean']:.4f}, KS reject rate: {results['ks_reject_rate']:.2%}")

print(f" AD mean: {results['ad_mean']:.4f}")

except Exception as e:

print(f" Error: {e}")

portfolio_results[name] = None

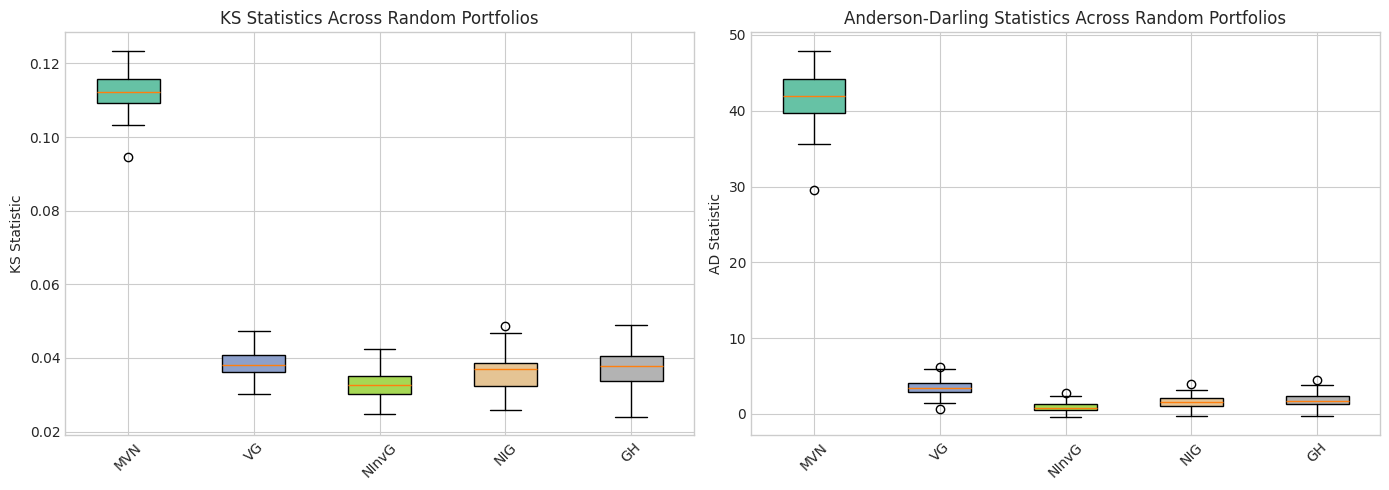

Running portfolio projection tests...

Testing with 100 random portfolios

Testing MVN...

KS mean: 0.1124, KS reject rate: 100.00%

AD mean: 41.9969

Testing VG...

KS mean: 0.0384, KS reject rate: 15.00%

AD mean: 3.4969

Testing NInvG...

KS mean: 0.0328, KS reject rate: 1.00%

AD mean: 0.8984

Testing NIG...

KS mean: 0.0360, KS reject rate: 10.00%

AD mean: 1.5887

Testing GH...

KS mean: 0.0374, KS reject rate: 19.00%

AD mean: 1.8635

[18]:

# Summary of portfolio tests

test_summary = []

for name, results in portfolio_results.items():

if results is not None:

test_summary.append({

'Distribution': name,

'KS Mean': results['ks_mean'],

'KS Median': results['ks_median'],

'KS Reject Rate': results['ks_reject_rate'],

'AD Mean': results['ad_mean'],

'AD Median': results['ad_median']

})

test_df = pd.DataFrame(test_summary)

test_df = test_df.sort_values('KS Mean')

print("\n" + "="*80)

print("PORTFOLIO PROJECTION TEST RESULTS")

print("Lower KS/AD statistics indicate better fit")

print("="*80)

print(test_df.to_string(index=False))

print("="*80)

================================================================================

PORTFOLIO PROJECTION TEST RESULTS

Lower KS/AD statistics indicate better fit

================================================================================

Distribution KS Mean KS Median KS Reject Rate AD Mean AD Median

NInvG 0.032845 0.032740 0.01 0.898434 0.797889

NIG 0.035985 0.037087 0.10 1.588689 1.574836

GH 0.037391 0.037722 0.19 1.863452 1.757622

VG 0.038414 0.038188 0.15 3.496930 3.348221

MVN 0.112396 0.112363 1.00 41.996915 41.885030

================================================================================

[19]:

# Visualize test statistics distribution

fig, axes = plt.subplots(1, 2, figsize=(14, 5))

# KS statistics boxplot

ax1 = axes[0]

ks_data = [portfolio_results[n]['ks_stats'] for n in fitted_dists.keys() if portfolio_results[n] is not None]

ks_labels = [n for n in fitted_dists.keys() if portfolio_results[n] is not None]

bp1 = ax1.boxplot(ks_data, labels=ks_labels, patch_artist=True)

for patch, color in zip(bp1['boxes'], colors[:len(ks_labels)]):

patch.set_facecolor(color)

ax1.set_ylabel('KS Statistic')

ax1.set_title('KS Statistics Across Random Portfolios')

ax1.tick_params(axis='x', rotation=45)

# AD statistics boxplot

ax2 = axes[1]

ad_data = [portfolio_results[n]['ad_stats'] for n in fitted_dists.keys() if portfolio_results[n] is not None]

ad_labels = [n for n in fitted_dists.keys() if portfolio_results[n] is not None]

bp2 = ax2.boxplot(ad_data, labels=ad_labels, patch_artist=True)

for patch, color in zip(bp2['boxes'], colors[:len(ad_labels)]):

patch.set_facecolor(color)

ax2.set_ylabel('AD Statistic')

ax2.set_title('Anderson-Darling Statistics Across Random Portfolios')

ax2.tick_params(axis='x', rotation=45)

plt.tight_layout()

plt.savefig('portfolio_test_boxplots.png', dpi=150, bbox_inches='tight')

plt.show()

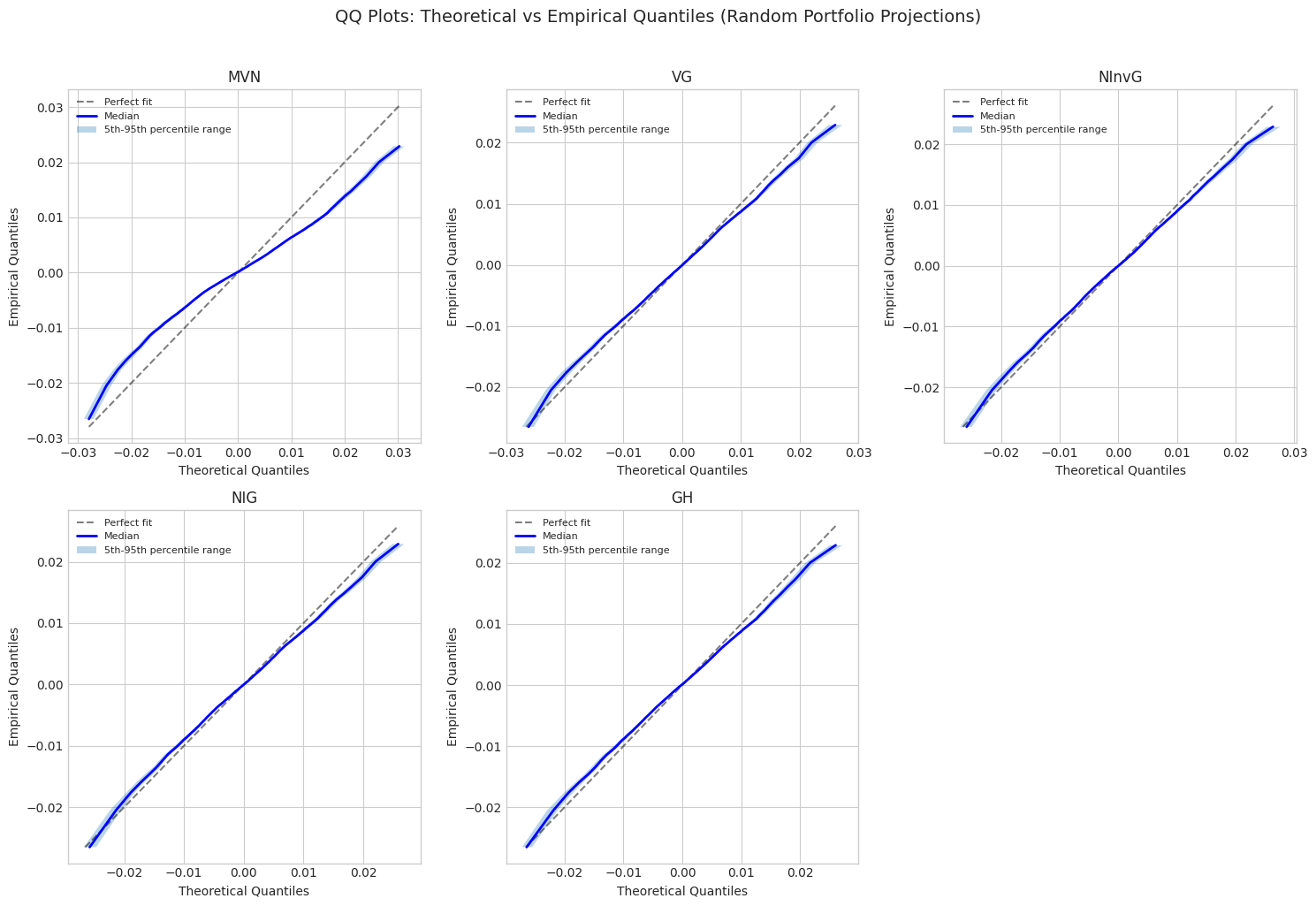

5. Quantile Range Plots

For each random portfolio, compare quantiles of simulated vs actual data.

[20]:

def compute_quantile_comparison(dist, returns_test, weights,

quantiles=np.linspace(0.01, 0.99, 99),

n_samples=10000, random_state=None):

"""

Compute quantile comparison for multiple portfolios.

Returns arrays of (empirical quantiles, theoretical quantiles) for each portfolio.

"""

# Generate samples

samples = dist.rvs(size=n_samples, random_state=random_state)

n_portfolios = weights.shape[0]

n_quantiles = len(quantiles)

empirical_quantiles = np.zeros((n_portfolios, n_quantiles))

theoretical_quantiles = np.zeros((n_portfolios, n_quantiles))

for i in range(n_portfolios):

w = weights[i]

test_proj = returns_test @ w

sample_proj = samples @ w

empirical_quantiles[i] = np.quantile(test_proj, quantiles)

theoretical_quantiles[i] = np.quantile(sample_proj, quantiles)

return empirical_quantiles, theoretical_quantiles, quantiles

[21]:

# Compute quantile comparisons for select distributions

quantile_results = {}

quantiles = np.linspace(0.01, 0.99, 99)

for name, dist in fitted_dists.items():

print(f"Computing quantiles for {name}...")

try:

emp_q, theo_q, q = compute_quantile_comparison(

dist, returns_test, random_weights,

quantiles=quantiles, n_samples=10000, random_state=42

)

quantile_results[name] = (emp_q, theo_q, q)

except Exception as e:

print(f" Error: {e}")

Computing quantiles for MVN...

Computing quantiles for VG...

Computing quantiles for NInvG...

Computing quantiles for NIG...

Computing quantiles for GH...

[22]:

# Create QQ plot comparing all distributions

fig, axes = plt.subplots(2, 3, figsize=(15, 10))

axes = axes.flatten()

for idx, (name, (emp_q, theo_q, q)) in enumerate(quantile_results.items()):

if idx >= len(axes):

break

ax = axes[idx]

# Plot quantile range (5th-95th percentile across portfolios)

emp_median = np.median(emp_q, axis=0)

emp_lower = np.percentile(emp_q, 5, axis=0)

emp_upper = np.percentile(emp_q, 95, axis=0)

theo_median = np.median(theo_q, axis=0)

theo_lower = np.percentile(theo_q, 5, axis=0)

theo_upper = np.percentile(theo_q, 95, axis=0)

# Plot diagonal

min_val = min(emp_median.min(), theo_median.min())

max_val = max(emp_median.max(), theo_median.max())

ax.plot([min_val, max_val], [min_val, max_val], 'k--', alpha=0.5, label='Perfect fit')

# Plot median QQ line

ax.plot(theo_median, emp_median, 'b-', lw=2, label='Median')

# Plot confidence band

ax.fill_betweenx(emp_median, theo_lower, theo_upper, alpha=0.3,

label='5th-95th percentile range')

ax.set_xlabel('Theoretical Quantiles')

ax.set_ylabel('Empirical Quantiles')

ax.set_title(f'{name}')

ax.legend(loc='upper left', fontsize=8)

# Hide unused subplots

for idx in range(len(quantile_results), len(axes)):

axes[idx].set_visible(False)

plt.suptitle('QQ Plots: Theoretical vs Empirical Quantiles (Random Portfolio Projections)',

fontsize=14, y=1.02)

plt.tight_layout()

plt.savefig('qq_plots_comparison.png', dpi=150, bbox_inches='tight')

plt.show()

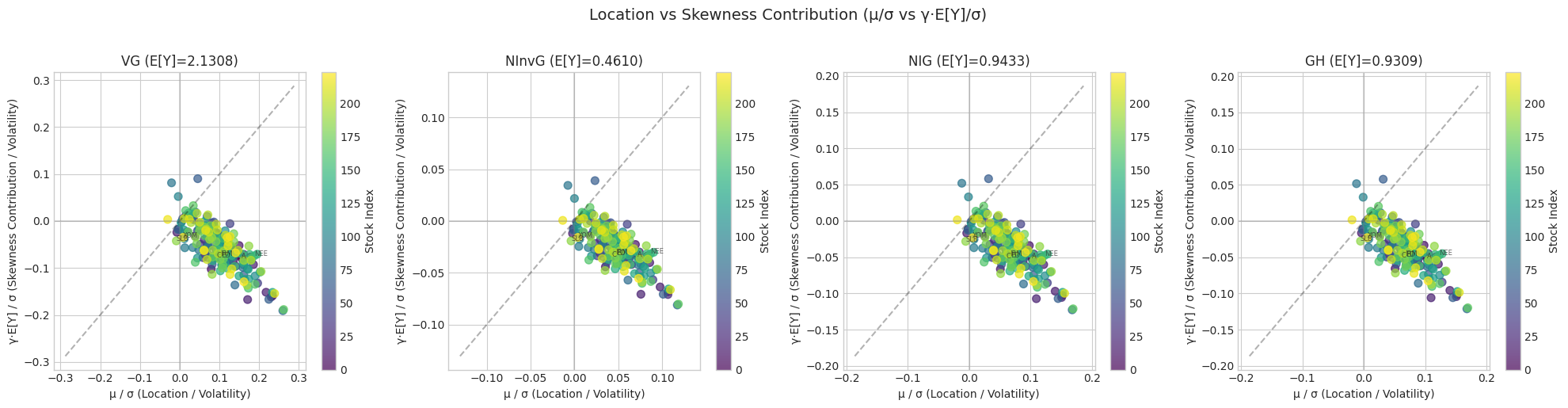

6. Parameter Analysis: Location (μ) vs Skewness (γ)

For normal mixture distributions, compare the location parameter μ and skewness parameter γ across stocks. We normalize by the volatility σ for comparison.

[27]:

# Extract parameters from fitted distributions

from normix.utils.bessel import log_kv

def compute_E_Y(name, params):

"""

Compute E[Y] for the mixing distribution of each normal mixture type.

- VG (Gamma): E[Y] = α / β (shape / rate)

- NInvG (InvGamma): E[Y] = β / (α - 1) for α > 1 (rate / (shape - 1))

- NIG (InvGaussian): E[Y] = δ (delta)

- GH (GIG): E[Y] = √(b/a) * K_{p+1}(√(ab)) / K_p(√(ab))

"""

if name == 'VG':

alpha = params['shape']

beta = params['rate']

return alpha / beta

elif name == 'NInvG':

alpha = params['shape']

beta = params['rate']

if alpha > 1:

return beta / (alpha - 1)

else:

return np.inf

elif name == 'NIG':

return params['delta']

elif name == 'GH':

p = params['p']

a = params['a']

b = params['b']

sqrt_ab = np.sqrt(a * b)

sqrt_b_over_a = np.sqrt(b / a) if a > 0 else np.inf

log_kv_p = log_kv(p, sqrt_ab)

log_kv_pp1 = log_kv(p + 1, sqrt_ab)

E_Y = sqrt_b_over_a * np.exp(log_kv_pp1 - log_kv_p)

return E_Y

else:

return 1.0 # Default for MVN or unknown

def extract_mixture_params(dist, name):

"""

Extract μ, γ, σ (diagonal of Σ), and E[Y] from normal mixture distributions.

Returns:

mu: Location parameter

gamma: Skewness parameter

sigma_diag: Diagonal of covariance (volatilities)

E_Y: Expected value of mixing variable

full_params: All classical parameters

mix_params: Mixing distribution parameters

"""

if name == 'MVN':

params = dist.classical_params

mu = params.mu

sigma_diag = np.sqrt(np.diag(params.sigma))

gamma = np.zeros_like(mu) # No skewness parameter for MVN

E_Y = 1.0 # MVN is not a mixture

return mu, gamma, sigma_diag, E_Y, None, None

else:

params = dist.classical_params

mu = params.mu

gamma = params.gamma

sigma_diag = np.sqrt(np.diag(params.sigma))

# Get mixing distribution parameters

if name == 'VG':

mix_params = {'shape': params.shape, 'rate': params.rate}

elif name == 'NInvG':

mix_params = {'shape': params.shape, 'rate': params.rate}

elif name == 'NIG':

mix_params = {'delta': params.delta, 'eta': params.eta}

elif name == 'GH':

mix_params = {'p': params.p, 'a': params.a, 'b': params.b}

else:

mix_params = None

# Compute E[Y]

E_Y = compute_E_Y(name, params)

return mu, gamma, sigma_diag, E_Y, params, mix_params

# Extract parameters for all mixture distributions

param_data = {}

for name, dist in fitted_dists.items():

try:

mu, gamma, sigma, E_Y, full_params, mix_params = extract_mixture_params(dist, name)

param_data[name] = {

'mu': mu,

'gamma': gamma,

'sigma': sigma,

'E_Y': E_Y,

'mu_over_sigma': mu / sigma,

'gamma_over_sigma': gamma / sigma,

'gamma_E_Y_over_sigma': gamma * E_Y / sigma, # The comparable quantity

'full_params': full_params,

'mix_params': mix_params

}

print(f"{name}: μ range [{mu.min():.6f}, {mu.max():.6f}], γ range [{gamma.min():.6f}, {gamma.max():.6f}], E[Y] = {E_Y:.6f}")

print(f" γ*E[Y] range [{(gamma*E_Y).min():.6f}, {(gamma*E_Y).max():.6f}]")

except Exception as e:

print(f"Error extracting params for {name}: {e}")

MVN: μ range [-0.000885, 0.002879], γ range [0.000000, 0.000000], E[Y] = 1.000000

γ*E[Y] range [0.000000, 0.000000]

VG: μ range [-0.000381, 0.004421], γ range [-0.000963, 0.000496], E[Y] = 2.130790

γ*E[Y] range [-0.002052, 0.001057]

NInvG: μ range [-0.000356, 0.004371], γ range [-0.004009, 0.002058], E[Y] = 0.460976

γ*E[Y] range [-0.001848, 0.000949]

NIG: μ range [-0.000369, 0.004393], γ range [-0.002111, 0.001086], E[Y] = 0.943274

γ*E[Y] range [-0.001992, 0.001025]

GH: μ range [-0.000369, 0.004396], γ range [-0.002117, 0.001089], E[Y] = 0.930902

γ*E[Y] range [-0.001971, 0.001014]

[28]:

# Create scatter plots comparing μ/σ vs γ*E[Y]/σ for each stock

# Note: For normal mixture X = μ + γY + √Y * Z, the contribution of γ to E[X] is γ*E[Y]

# So comparing μ/σ to γ*E[Y]/σ gives a better sense of relative contributions

mixture_dists = [n for n in ['VG', 'NInvG', 'NIG', 'GH'] if n in param_data]

if mixture_dists:

n_plots = len(mixture_dists)

fig, axes = plt.subplots(1, n_plots, figsize=(5*n_plots, 5))

if n_plots == 1:

axes = [axes]

for idx, name in enumerate(mixture_dists):

ax = axes[idx]

data = param_data[name]

mu_norm = data['mu_over_sigma']

gamma_E_Y_norm = data['gamma_E_Y_over_sigma'] # γ*E[Y]/σ instead of γ/σ

# Scatter plot

scatter = ax.scatter(mu_norm, gamma_E_Y_norm, c=range(len(mu_norm)),

cmap='viridis', s=50, alpha=0.7)

# Add diagonal line

lim = max(abs(mu_norm).max(), abs(gamma_E_Y_norm).max()) * 1.1

if np.isfinite(lim) and lim > 0:

ax.plot([-lim, lim], [-lim, lim], 'k--', alpha=0.3, label='μ = γE[Y]')

ax.axhline(0, color='gray', linestyle='-', alpha=0.3)

ax.axvline(0, color='gray', linestyle='-', alpha=0.3)

# Labels

ax.set_xlabel('μ / σ (Location / Volatility)')

ax.set_ylabel('γ·E[Y] / σ (Skewness Contribution / Volatility)')

ax.set_title(f'{name} (E[Y]={data["E_Y"]:.4f})')

# Add colorbar to show stock index

plt.colorbar(scatter, ax=ax, label='Stock Index')

# Add labels for a few interesting points

n_labels = min(len(selected_tickers), 6) # Label up to 6 stocks

step = max(1, len(selected_tickers) // n_labels)

for i, ticker in enumerate(selected_tickers):

if i % step == 0:

ax.annotate(ticker, (mu_norm[i], gamma_E_Y_norm[i]), fontsize=6, alpha=0.7)

plt.suptitle('Location vs Skewness Contribution (μ/σ vs γ·E[Y]/σ)', fontsize=14, y=1.02)

plt.tight_layout()

plt.savefig('mu_vs_gamma_E_Y_scatter.png', dpi=150, bbox_inches='tight')

plt.show()

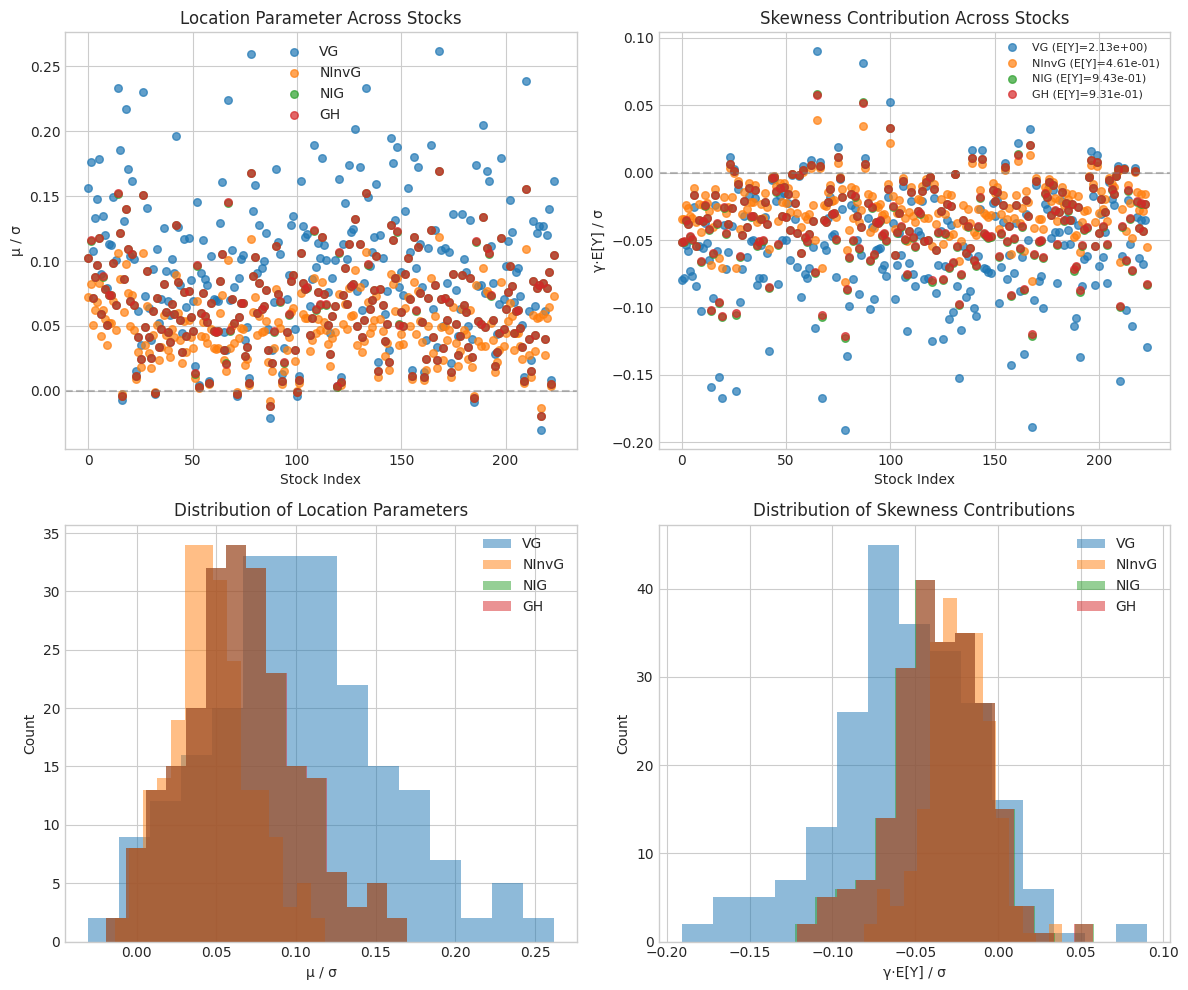

[29]:

# Create combined comparison plot using γ*E[Y]/σ for fair comparison

if len(mixture_dists) >= 2:

fig, axes = plt.subplots(2, 2, figsize=(12, 10))

# Plot 1: μ/σ comparison across distributions

ax1 = axes[0, 0]

for name in mixture_dists:

data = param_data[name]

ax1.scatter(range(len(data['mu_over_sigma'])), data['mu_over_sigma'],

label=name, alpha=0.7, s=30)

ax1.set_xlabel('Stock Index')

ax1.set_ylabel('μ / σ')

ax1.set_title('Location Parameter Across Stocks')

ax1.legend()

ax1.axhline(0, color='gray', linestyle='--', alpha=0.5)

# Plot 2: γ*E[Y]/σ comparison across distributions (scaled skewness contribution)

ax2 = axes[0, 1]

for name in mixture_dists:

data = param_data[name]

ax2.scatter(range(len(data['gamma_E_Y_over_sigma'])), data['gamma_E_Y_over_sigma'],

label=f"{name} (E[Y]={data['E_Y']:.2e})", alpha=0.7, s=30)

ax2.set_xlabel('Stock Index')

ax2.set_ylabel('γ·E[Y] / σ')

ax2.set_title('Skewness Contribution Across Stocks')

ax2.legend(fontsize=8)

ax2.axhline(0, color='gray', linestyle='--', alpha=0.5)

# Plot 3: μ/σ histograms

ax3 = axes[1, 0]

for name in mixture_dists:

data = param_data[name]

ax3.hist(data['mu_over_sigma'], bins=15, alpha=0.5, label=name)

ax3.set_xlabel('μ / σ')

ax3.set_ylabel('Count')

ax3.set_title('Distribution of Location Parameters')

ax3.legend()

# Plot 4: γ*E[Y]/σ histograms (scaled skewness contribution)

ax4 = axes[1, 1]

for name in mixture_dists:

data = param_data[name]

ax4.hist(data['gamma_E_Y_over_sigma'], bins=15, alpha=0.5, label=name)

ax4.set_xlabel('γ·E[Y] / σ')

ax4.set_ylabel('Count')

ax4.set_title('Distribution of Skewness Contributions')

ax4.legend()

plt.tight_layout()

plt.savefig('parameter_comparison.png', dpi=150, bbox_inches='tight')

plt.show()

[30]:

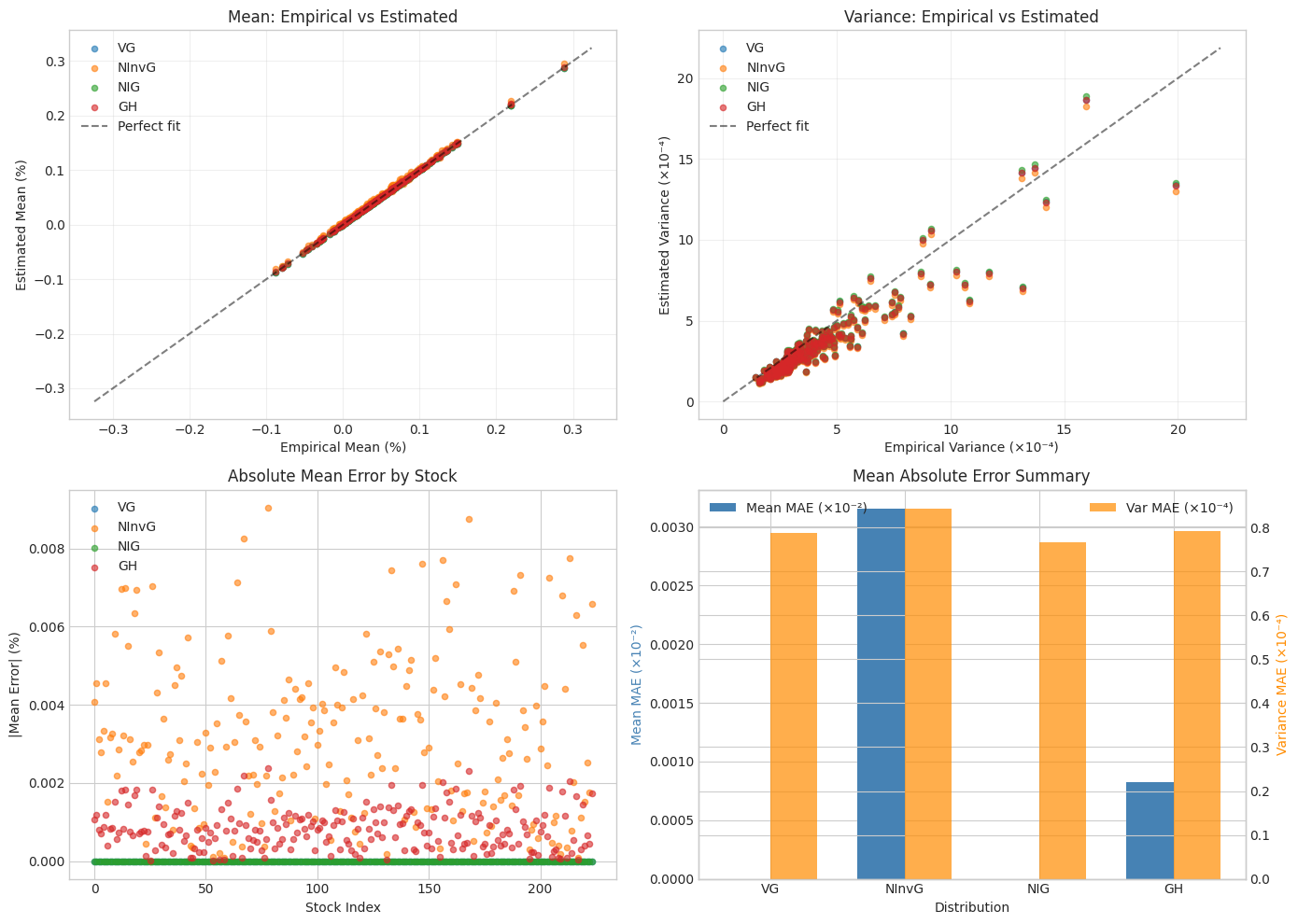

# Compare Mean, Variance, and Skewness from Estimated Distributions

# For normal variance-mean mixture X = μ + γY + √Y·ε where ε ~ N(0, Σ):

# - E[X] = μ + γE[Y]

# - Var[X]_i = E[Y]·Σ_ii + Var[Y]·γ_i²

def compute_Var_Y(name, params):

"""

Compute Var[Y] for the mixing distribution.

- VG (Gamma): Var[Y] = α / β² (shape / rate²)

- NInvG (InvGamma): Var[Y] = β² / ((α-1)²(α-2)) for α > 2

- NIG (InvGaussian): Var[Y] = δ³ / η (delta³ / eta)

- GH (GIG): Var[Y] = E[Y²] - E[Y]² computed via Bessel ratios

"""

if name == 'VG':

alpha = params['shape']

beta = params['rate']

return alpha / (beta ** 2)

elif name == 'NInvG':

alpha = params['shape']

beta = params['rate']

if alpha > 2:

return (beta ** 2) / ((alpha - 1) ** 2 * (alpha - 2))

else:

return np.inf

elif name == 'NIG':

delta = params['delta']

eta = params['eta']

return (delta ** 3) / eta

elif name == 'GH':

p = params['p']

a = params['a']

b = params['b']

sqrt_ab = np.sqrt(a * b)

sqrt_b_over_a = np.sqrt(b / a) if a > 0 else np.inf

log_kv_p = log_kv(p, sqrt_ab)

log_kv_pp1 = log_kv(p + 1, sqrt_ab)

log_kv_pp2 = log_kv(p + 2, sqrt_ab)

E_Y = sqrt_b_over_a * np.exp(log_kv_pp1 - log_kv_p)

E_Y2 = (b / a) * np.exp(log_kv_pp2 - log_kv_p)

return E_Y2 - E_Y ** 2

else:

return 0.0

print("="*80)

print("MOMENT COMPARISON FROM ESTIMATED DISTRIBUTIONS")

print("="*80)

# Compare empirical moments with distribution moments

empirical_mean = returns_train.mean(axis=0)

empirical_var = returns_train.var(axis=0)

empirical_skew = stats.skew(returns_train, axis=0)

moment_comparison = {}

for name in mixture_dists:

data = param_data[name]

mu = data['mu']

gamma = data['gamma']

sigma_diag_sq = data['sigma'] ** 2 # Variance (diagonal of Σ)

E_Y = data['E_Y']

Var_Y = compute_Var_Y(name, data['full_params'])

# Compute distribution mean: E[X] = μ + γE[Y]

dist_mean = mu + gamma * E_Y

# Compute distribution variance: Var[X]_i = E[Y]·Σ_ii + Var[Y]·γ_i²

dist_var = E_Y * sigma_diag_sq + Var_Y * (gamma ** 2)

moment_comparison[name] = {

'E_Y': E_Y,

'Var_Y': Var_Y,

'dist_mean': dist_mean,

'dist_var': dist_var,

'dist_std': np.sqrt(dist_var),

'mean_error': np.mean(np.abs(dist_mean - empirical_mean)),

'var_error': np.mean(np.abs(dist_var - empirical_var))

}

print(f"\n{name}:")

print(f" E[Y] = {E_Y:.6e}, Var[Y] = {Var_Y:.6e}")

print(f" Mean: Dist avg = {dist_mean.mean():.6e}, Empirical avg = {empirical_mean.mean():.6e}")

print(f" MAE = {moment_comparison[name]['mean_error']:.6e}")

print(f" Var: Dist avg = {dist_var.mean():.6e}, Empirical avg = {empirical_var.mean():.6e}")

print(f" MAE = {moment_comparison[name]['var_error']:.6e}")

# Create comparison visualization

fig, axes = plt.subplots(2, 2, figsize=(14, 10))

# Plot 1: Mean comparison (scatter: empirical vs estimated)

ax1 = axes[0, 0]

for name in mixture_dists:

mc = moment_comparison[name]

ax1.scatter(empirical_mean * 100, mc['dist_mean'] * 100, label=name, alpha=0.6, s=20)

# Add diagonal line

lim = max(abs(empirical_mean).max(), max(abs(mc['dist_mean']).max() for mc in moment_comparison.values())) * 100 * 1.1

ax1.plot([-lim, lim], [-lim, lim], 'k--', alpha=0.5, label='Perfect fit')

ax1.set_xlabel('Empirical Mean (%)')

ax1.set_ylabel('Estimated Mean (%)')

ax1.set_title('Mean: Empirical vs Estimated')

ax1.legend()

ax1.grid(True, alpha=0.3)

# Plot 2: Variance comparison (scatter: empirical vs estimated)

ax2 = axes[0, 1]

for name in mixture_dists:

mc = moment_comparison[name]

ax2.scatter(empirical_var * 10000, mc['dist_var'] * 10000, label=name, alpha=0.6, s=20)

lim = max(empirical_var.max(), max(mc['dist_var'].max() for mc in moment_comparison.values() if np.isfinite(mc['dist_var']).all())) * 10000 * 1.1

ax2.plot([0, lim], [0, lim], 'k--', alpha=0.5, label='Perfect fit')

ax2.set_xlabel('Empirical Variance (×10⁻⁴)')

ax2.set_ylabel('Estimated Variance (×10⁻⁴)')

ax2.set_title('Variance: Empirical vs Estimated')

ax2.legend()

ax2.grid(True, alpha=0.3)

# Plot 3: Mean error by stock

ax3 = axes[1, 0]

for name in mixture_dists:

mc = moment_comparison[name]

mean_errors = np.abs(mc['dist_mean'] - empirical_mean) * 100

ax3.scatter(range(len(mean_errors)), mean_errors, label=name, alpha=0.6, s=20)

ax3.set_xlabel('Stock Index')

ax3.set_ylabel('|Mean Error| (%)')

ax3.set_title('Absolute Mean Error by Stock')

ax3.legend()

# Plot 4: Summary statistics

ax4 = axes[1, 1]

names = list(moment_comparison.keys())

mean_maes = [moment_comparison[n]['mean_error'] * 100 for n in names]

var_maes = [moment_comparison[n]['var_error'] * 10000 for n in names]

x = np.arange(len(names))

width = 0.35

bars1 = ax4.bar(x - width/2, mean_maes, width, label='Mean MAE (×10⁻²)', color='steelblue')

ax4_twin = ax4.twinx()

bars2 = ax4_twin.bar(x + width/2, var_maes, width, label='Var MAE (×10⁻⁴)', color='darkorange', alpha=0.7)

ax4.set_xlabel('Distribution')

ax4.set_ylabel('Mean MAE (×10⁻²)', color='steelblue')

ax4_twin.set_ylabel('Variance MAE (×10⁻⁴)', color='darkorange')

ax4.set_xticks(x)

ax4.set_xticklabels(names)

ax4.set_title('Mean Absolute Error Summary')

ax4.legend(loc='upper left')

ax4_twin.legend(loc='upper right')

plt.tight_layout()

plt.savefig('moment_comparison.png', dpi=150, bbox_inches='tight')

plt.show()

# Print summary table

print("\n" + "="*80)

print("SUMMARY TABLE: Distribution Moment Comparison")

print("="*80)

summary_df = pd.DataFrame({

'Distribution': names,

'E[Y]': [moment_comparison[n]['E_Y'] for n in names],

'Var[Y]': [moment_comparison[n]['Var_Y'] for n in names],

'Mean MAE': [moment_comparison[n]['mean_error'] for n in names],

'Var MAE': [moment_comparison[n]['var_error'] for n in names]

})

print(summary_df.to_string(index=False))

================================================================================

MOMENT COMPARISON FROM ESTIMATED DISTRIBUTIONS

================================================================================

VG:

E[Y] = 2.130790e+00, Var[Y] = 2.229780e+00

Mean: Dist avg = 5.226405e-04, Empirical avg = 5.226405e-04

MAE = 2.464937e-17

Var: Dist avg = 3.526543e-04, Empirical avg = 4.178537e-04

MAE = 7.873155e-05

NInvG:

E[Y] = 4.609764e-01, Var[Y] = 2.382077e-01

Mean: Dist avg = 5.522672e-04, Empirical avg = 5.226405e-04

MAE = 3.157227e-05

Var: Dist avg = 3.439041e-04, Empirical avg = 4.178537e-04

MAE = 8.438055e-05

NIG:

E[Y] = 9.432736e-01, Var[Y] = 5.249672e-01

Mean: Dist avg = 5.226405e-04, Empirical avg = 5.226405e-04

MAE = 1.786790e-17

Var: Dist avg = 3.567892e-04, Empirical avg = 4.178537e-04

MAE = 7.660339e-05

GH:

E[Y] = 9.309021e-01, Var[Y] = 4.867629e-01

Mean: Dist avg = 5.303291e-04, Empirical avg = 5.226405e-04

MAE = 8.222104e-06

Var: Dist avg = 3.521624e-04, Empirical avg = 4.178537e-04

MAE = 7.925527e-05

================================================================================

SUMMARY TABLE: Distribution Moment Comparison

================================================================================

Distribution E[Y] Var[Y] Mean MAE Var MAE

VG 2.130790 2.229780 2.464937e-17 0.000079

NInvG 0.460976 0.238208 3.157227e-05 0.000084

NIG 0.943274 0.524967 1.786790e-17 0.000077

GH 0.930902 0.486763 8.222104e-06 0.000079

[31]:

# Create a detailed parameter table for one distribution (e.g., GH)

best_dist = 'GH' if 'GH' in param_data else list(param_data.keys())[-1]

if best_dist in param_data:

data = param_data[best_dist]

param_table = pd.DataFrame({

'Ticker': selected_tickers,

'μ': data['mu'],

'γ': data['gamma'],

'γ·E[Y]': data['gamma'] * data['E_Y'], # Skewness contribution

'σ': data['sigma'],

'μ/σ': data['mu_over_sigma'],

'γ/σ': data['gamma_over_sigma'],

'γ·E[Y]/σ': data['gamma_E_Y_over_sigma'] # Comparable skewness measure

})

# Sort by γ*E[Y]/σ to see which stocks have most skewness contribution

param_table_sorted = param_table.sort_values('γ·E[Y]/σ')

print(f"\n{best_dist} Parameters by Stock (sorted by skewness contribution γ·E[Y]/σ):")

print(f"Note: E[Y] = {data['E_Y']:.6e}")

print("="*100)

print(param_table_sorted.to_string(index=False))

print("="*100)

# Print mixing distribution parameters

if data['mix_params']:

print(f"\n{best_dist} Mixing Distribution Parameters:")

for k, v in data['mix_params'].items():

if isinstance(v, float):

print(f" {k}: {v:.6e}")

else:

print(f" {k}: {v}")

GH Parameters by Stock (sorted by skewness contribution γ·E[Y]/σ):

Note: E[Y] = 9.309021e-01

====================================================================================================

Ticker μ γ γ·E[Y] σ μ/σ γ/σ γ·E[Y]/σ

EQIX 0.002732 -0.002117 -0.001971 0.016250 0.168124 -0.130298 -0.121294

PLD 0.002697 -0.002047 -0.001905 0.015900 0.169643 -0.128726 -0.119831

AVB 0.001572 -0.001632 -0.001519 0.014332 0.109678 -0.113883 -0.106014

DLR 0.002471 -0.001936 -0.001802 0.017023 0.145175 -0.113722 -0.105864

BAX 0.002180 -0.001620 -0.001508 0.014438 0.150969 -0.112205 -0.104452

AMT 0.002267 -0.001627 -0.001515 0.014909 0.152069 -0.109153 -0.101611

V 0.002322 -0.001581 -0.001472 0.014910 0.155760 -0.106027 -0.098701

MCO 0.002518 -0.001727 -0.001608 0.016513 0.152459 -0.104580 -0.097354

ARE 0.002036 -0.001493 -0.001389 0.014504 0.140361 -0.102904 -0.095794

O 0.001797 -0.001570 -0.001461 0.016166 0.111162 -0.097088 -0.090379

STZ 0.001997 -0.001702 -0.001585 0.018145 0.110075 -0.093823 -0.087340

PEP 0.001399 -0.001050 -0.000978 0.011309 0.123745 -0.092881 -0.086463

EQR 0.001334 -0.001387 -0.001292 0.015030 0.088731 -0.092311 -0.085933

CCI 0.001874 -0.001332 -0.001240 0.014684 0.127649 -0.090706 -0.084438

ZBH 0.001811 -0.001532 -0.001426 0.017278 0.104799 -0.088642 -0.082517

KO 0.001222 -0.000984 -0.000916 0.011452 0.106712 -0.085904 -0.079968

LMT 0.001580 -0.001186 -0.001104 0.013962 0.113161 -0.084938 -0.079069

MDLZ 0.001393 -0.001155 -0.001075 0.014290 0.097484 -0.080795 -0.075212

ICE 0.001774 -0.001155 -0.001075 0.014357 0.123588 -0.080427 -0.074869

DHI 0.002192 -0.001652 -0.001538 0.020822 0.105276 -0.079321 -0.073840

WELL 0.001554 -0.001477 -0.001375 0.018990 0.081835 -0.077775 -0.072401

SPG 0.001088 -0.001631 -0.001518 0.021141 0.051467 -0.077130 -0.071801

MA 0.002202 -0.001246 -0.001160 0.016652 0.132255 -0.074842 -0.069671

SPGI 0.002147 -0.001185 -0.001103 0.016006 0.134159 -0.074051 -0.068934

MO 0.001023 -0.001128 -0.001050 0.015396 0.066440 -0.073286 -0.068222

MCD 0.001392 -0.000879 -0.000818 0.012290 0.113236 -0.071493 -0.066553

AIG 0.000979 -0.001355 -0.001261 0.019193 0.051021 -0.070595 -0.065717

FIS 0.001635 -0.001023 -0.000952 0.014644 0.111645 -0.069834 -0.065009

MMM 0.001162 -0.001032 -0.000960 0.014796 0.078518 -0.069717 -0.064899

VRTX 0.002219 -0.001820 -0.001694 0.026254 0.084504 -0.069306 -0.064518

ES 0.001361 -0.000889 -0.000828 0.013156 0.103473 -0.067569 -0.062900

PSA 0.001003 -0.000989 -0.000920 0.014670 0.068347 -0.067403 -0.062746

NOC 0.001381 -0.001019 -0.000949 0.015285 0.090336 -0.066674 -0.062067

BDX 0.001380 -0.000995 -0.000926 0.014946 0.092338 -0.066557 -0.061958

HD 0.001503 -0.000921 -0.000858 0.014127 0.106411 -0.065214 -0.060708

PM 0.001116 -0.001026 -0.000955 0.015773 0.070738 -0.065070 -0.060574

GD 0.001016 -0.000955 -0.000889 0.014742 0.068937 -0.064767 -0.060291

AMZN 0.002434 -0.001279 -0.001191 0.020011 0.121648 -0.063916 -0.059500

CVS 0.000986 -0.001187 -0.001105 0.018650 0.052868 -0.063645 -0.059247

MET 0.001381 -0.001259 -0.001172 0.019795 0.069788 -0.063618 -0.059223

LEN 0.001626 -0.001352 -0.001259 0.022065 0.073712 -0.061272 -0.057038

OXY 0.000671 -0.001652 -0.001538 0.027419 0.024487 -0.060244 -0.056081

EXR 0.001270 -0.000981 -0.000913 0.016287 0.078008 -0.060225 -0.056063

MKC 0.001488 -0.000857 -0.000797 0.014335 0.103816 -0.059761 -0.055632

MCK 0.001131 -0.001218 -0.001134 0.020780 0.054418 -0.058632 -0.054580

ISRG 0.002259 -0.001114 -0.001037 0.019096 0.118292 -0.058347 -0.054315

AEP 0.001120 -0.000738 -0.000687 0.012701 0.088154 -0.058070 -0.054058

TMO 0.001859 -0.000914 -0.000851 0.015750 0.118044 -0.058033 -0.054023

SYK 0.001642 -0.000897 -0.000835 0.015508 0.105871 -0.057843 -0.053846

BSX 0.001485 -0.001038 -0.000966 0.018023 0.082368 -0.057570 -0.053592

UAL 0.001311 -0.001666 -0.001551 0.029172 0.044947 -0.057100 -0.053154

CL 0.000951 -0.000709 -0.000660 0.012438 0.076432 -0.056963 -0.053027

RTX 0.001089 -0.000934 -0.000870 0.016431 0.066274 -0.056848 -0.052920

A 0.001762 -0.000945 -0.000879 0.017206 0.102394 -0.054908 -0.051114

PPG 0.001177 -0.000904 -0.000842 0.016506 0.071295 -0.054778 -0.050993

AAPL 0.002220 -0.001045 -0.000973 0.019162 0.115872 -0.054547 -0.050778

NVDA 0.003874 -0.001784 -0.001661 0.032714 0.118435 -0.054539 -0.050771

C 0.001262 -0.001137 -0.001058 0.020852 0.060513 -0.054521 -0.050754

DAL 0.001126 -0.001320 -0.001228 0.024302 0.046323 -0.054302 -0.050550

KHC 0.000507 -0.000966 -0.000899 0.017869 0.028381 -0.054043 -0.050309

GOOGL 0.001484 -0.000895 -0.000834 0.016625 0.089292 -0.053864 -0.050142

ETR 0.001158 -0.000753 -0.000701 0.013986 0.082796 -0.053838 -0.050118

PRU 0.001114 -0.001091 -0.001015 0.020330 0.054810 -0.053656 -0.049949

CAH 0.000774 -0.001100 -0.001024 0.020535 0.037678 -0.053557 -0.049856

KMB 0.000888 -0.000726 -0.000675 0.013581 0.065409 -0.053424 -0.049733

ADBE 0.002312 -0.001047 -0.000975 0.019677 0.117509 -0.053227 -0.049549

IBM 0.000867 -0.000820 -0.000763 0.015441 0.056130 -0.053089 -0.049421

ED 0.000877 -0.000685 -0.000637 0.012897 0.067963 -0.053080 -0.049412

OKE 0.001942 -0.001348 -0.001255 0.025807 0.075261 -0.052251 -0.048640

MU 0.002923 -0.001735 -0.001615 0.033660 0.086840 -0.051535 -0.047974

IRM 0.001178 -0.000911 -0.000848 0.017674 0.066628 -0.051521 -0.047961

D 0.000894 -0.000681 -0.000634 0.013227 0.067620 -0.051495 -0.047936

NEE 0.001577 -0.000651 -0.000606 0.012842 0.122822 -0.050710 -0.047206

ACN 0.001475 -0.000768 -0.000715 0.015193 0.097062 -0.050540 -0.047048

MSFT 0.001930 -0.000826 -0.000769 0.016629 0.116051 -0.049702 -0.046268

GM 0.001240 -0.001045 -0.000973 0.021068 0.058872 -0.049621 -0.046192

BIIB 0.001039 -0.001234 -0.001149 0.025054 0.041455 -0.049258 -0.045855

DD 0.000901 -0.000962 -0.000896 0.019746 0.045623 -0.048719 -0.045352

MSCI 0.002315 -0.000876 -0.000816 0.018103 0.127866 -0.048406 -0.045061

AWK 0.001448 -0.000664 -0.000619 0.013753 0.105292 -0.048313 -0.044975

NOW 0.002555 -0.001204 -0.001121 0.024948 0.102428 -0.048274 -0.044938

GOOG 0.001409 -0.000803 -0.000747 0.016646 0.084667 -0.048223 -0.044891

LOW 0.001496 -0.000891 -0.000829 0.018486 0.080918 -0.048176 -0.044847

CSCO 0.001296 -0.000821 -0.000764 0.017133 0.075643 -0.047904 -0.044594

TRV 0.000881 -0.000670 -0.000623 0.013997 0.062944 -0.047843 -0.044537

HLT 0.001555 -0.000888 -0.000826 0.018648 0.083406 -0.047596 -0.044307

LIN 0.001460 -0.000725 -0.000675 0.015371 0.094953 -0.047196 -0.043935

XEL 0.001166 -0.000589 -0.000548 0.012729 0.091638 -0.046238 -0.043043

INTC 0.001254 -0.000923 -0.000859 0.019972 0.062772 -0.046204 -0.043012

COST 0.001391 -0.000656 -0.000611 0.014393 0.096610 -0.045602 -0.042451

SYY 0.001284 -0.000786 -0.000731 0.017464 0.073502 -0.044992 -0.041884

AMGN 0.001091 -0.000740 -0.000689 0.016495 0.066125 -0.044881 -0.041780

WMB 0.001168 -0.001282 -0.001194 0.029333 0.039835 -0.043714 -0.040694

T 0.000755 -0.000598 -0.000557 0.013768 0.054870 -0.043463 -0.040460

BKNG 0.001199 -0.000845 -0.000787 0.019573 0.061271 -0.043192 -0.040208

F 0.000618 -0.000836 -0.000778 0.019486 0.031705 -0.042891 -0.039927

TTWO 0.002347 -0.001046 -0.000974 0.024457 0.095949 -0.042768 -0.039813

MPC 0.001074 -0.001189 -0.001107 0.027802 0.038617 -0.042755 -0.039800

META 0.001533 -0.000841 -0.000783 0.019729 0.077708 -0.042632 -0.039686

VLO 0.000958 -0.001024 -0.000953 0.024033 0.039858 -0.042595 -0.039652

HSY 0.001065 -0.000569 -0.000530 0.013364 0.079708 -0.042580 -0.039638

PEG 0.000987 -0.000586 -0.000545 0.013757 0.071755 -0.042562 -0.039621

NXPI 0.001440 -0.000978 -0.000910 0.023230 0.061997 -0.042098 -0.039189

CB 0.000846 -0.000582 -0.000542 0.014301 0.059168 -0.040698 -0.037886

AXP 0.001123 -0.000687 -0.000640 0.016892 0.066495 -0.040689 -0.037878

ABT 0.001372 -0.000636 -0.000592 0.015634 0.087727 -0.040683 -0.037872

APD 0.001260 -0.000588 -0.000548 0.014666 0.085902 -0.040106 -0.037334

GILD 0.000398 -0.000725 -0.000675 0.018148 0.021909 -0.039933 -0.037174

GE 0.000195 -0.000973 -0.000906 0.024830 0.007842 -0.039187 -0.036479

DTE 0.000932 -0.000512 -0.000476 0.013091 0.071166 -0.039100 -0.036398

ALL 0.000980 -0.000509 -0.000474 0.013247 0.073999 -0.038417 -0.035763

DG 0.001553 -0.000700 -0.000651 0.018308 0.084844 -0.038219 -0.035578

GIS 0.000686 -0.000573 -0.000533 0.015073 0.045492 -0.037992 -0.035367

SHW 0.001385 -0.000602 -0.000560 0.015891 0.087141 -0.037857 -0.035241

ABBV 0.001338 -0.000710 -0.000661 0.018755 0.071316 -0.037839 -0.035224

MDT 0.000914 -0.000543 -0.000506 0.014441 0.063265 -0.037628 -0.035028

AES 0.001586 -0.000759 -0.000706 0.020194 0.078516 -0.037579 -0.034982

DLTR 0.001010 -0.000815 -0.000758 0.021700 0.046566 -0.037540 -0.034946

SNPS 0.001948 -0.000631 -0.000588 0.016921 0.115115 -0.037317 -0.034738

CAG 0.000884 -0.000721 -0.000671 0.019531 0.045272 -0.036902 -0.034352

WEC 0.001031 -0.000471 -0.000438 0.012958 0.079573 -0.036310 -0.033801

AMD 0.004396 -0.001610 -0.001499 0.044745 0.098241 -0.035980 -0.033494

COF 0.000979 -0.000747 -0.000695 0.021300 0.045962 -0.035053 -0.032631

BLK 0.001234 -0.000599 -0.000558 0.017174 0.071823 -0.034874 -0.032464

PG 0.000942 -0.000398 -0.000371 0.011539 0.081673 -0.034528 -0.032142

CME 0.001161 -0.000519 -0.000483 0.015035 0.077201 -0.034524 -0.032138

BMY 0.000624 -0.000631 -0.000587 0.018327 0.034066 -0.034411 -0.032033

EXC 0.000954 -0.000502 -0.000468 0.014647 0.065155 -0.034298 -0.031928

REGN 0.000681 -0.000827 -0.000770 0.024656 0.027616 -0.033546 -0.031228

EA 0.001245 -0.000711 -0.000662 0.021763 0.057206 -0.032662 -0.030406

JNJ 0.000809 -0.000391 -0.000364 0.012143 0.066608 -0.032202 -0.029977

ECL 0.000942 -0.000447 -0.000416 0.013949 0.067501 -0.032068 -0.029853

HON 0.001099 -0.000445 -0.000414 0.013966 0.078709 -0.031865 -0.029663

TXN 0.001454 -0.000558 -0.000519 0.018001 0.080791 -0.031000 -0.028858

SBUX 0.000931 -0.000475 -0.000442 0.015324 0.060786 -0.030995 -0.028853

LLY 0.001100 -0.000502 -0.000467 0.016426 0.066949 -0.030560 -0.028448

ITW 0.001159 -0.000471 -0.000438 0.015581 0.074415 -0.030232 -0.028143

SLB -0.000129 -0.000705 -0.000657 0.023589 -0.005484 -0.029906 -0.027840

RSG 0.000989 -0.000330 -0.000308 0.011088 0.089237 -0.029800 -0.027741

BA 0.000981 -0.000667 -0.000621 0.023712 0.041379 -0.028147 -0.026202

AVGO 0.001555 -0.000621 -0.000578 0.022465 0.069237 -0.027639 -0.025729

FTNT 0.001788 -0.000654 -0.000609 0.023825 0.075025 -0.027468 -0.025570

SRE 0.000713 -0.000390 -0.000363 0.014448 0.049322 -0.026992 -0.025127

HAL 0.000227 -0.000746 -0.000695 0.027851 0.008163 -0.026793 -0.024941

MAR 0.001041 -0.000550 -0.000512 0.020690 0.050294 -0.026588 -0.024750

AMAT 0.001864 -0.000654 -0.000609 0.025178 0.074037 -0.025964 -0.024170

ORCL 0.000848 -0.000414 -0.000385 0.016009 0.052964 -0.025857 -0.024070

NSC 0.001295 -0.000469 -0.000436 0.018322 0.070670 -0.025574 -0.023807

SO 0.000697 -0.000320 -0.000298 0.013029 0.053529 -0.024579 -0.022881

XOM 0.000091 -0.000400 -0.000372 0.016267 0.005606 -0.024571 -0.022873

LRCX 0.002068 -0.000617 -0.000575 0.025148 0.082245 -0.024550 -0.022854

WMT 0.001132 -0.000351 -0.000327 0.014340 0.078938 -0.024474 -0.022783

CRM 0.001288 -0.000520 -0.000484 0.021490 0.059921 -0.024218 -0.022544

FDX 0.000941 -0.000496 -0.000461 0.020536 0.045798 -0.024134 -0.022466

SJM 0.000427 -0.000387 -0.000361 0.016271 0.026216 -0.023814 -0.022168

DUK 0.000647 -0.000284 -0.000265 0.012360 0.052350 -0.023013 -0.021423

CAT 0.001350 -0.000462 -0.000430 0.020097 0.067196 -0.023003 -0.021413

WM 0.000952 -0.000260 -0.000242 0.011398 0.083487 -0.022770 -0.021196

NFLX 0.001739 -0.000649 -0.000605 0.028627 0.060758 -0.022687 -0.021120

BK 0.000437 -0.000384 -0.000358 0.017224 0.025351 -0.022303 -0.020762

PFE 0.000569 -0.000295 -0.000275 0.013732 0.041426 -0.021483 -0.019998

TSLA 0.002960 -0.000820 -0.000764 0.038982 0.075926 -0.021044 -0.019590

MRK 0.000719 -0.000275 -0.000256 0.013957 0.051520 -0.019732 -0.018368

PYPL 0.001858 -0.000400 -0.000372 0.020574 0.090323 -0.019432 -0.018089

EOG 0.000167 -0.000501 -0.000466 0.026227 0.006372 -0.019096 -0.017776

EW 0.001302 -0.000390 -0.000363 0.020673 0.062975 -0.018848 -0.017545

ADI 0.001158 -0.000349 -0.000325 0.019525 0.059312 -0.017877 -0.016642

APA -0.000147 -0.000675 -0.000629 0.037888 -0.003867 -0.017821 -0.016590

ETN 0.001021 -0.000287 -0.000267 0.016973 0.060156 -0.016910 -0.015741

UPS 0.000753 -0.000260 -0.000242 0.015462 0.048723 -0.016814 -0.015652

COP 0.000344 -0.000429 -0.000399 0.025642 0.013428 -0.016722 -0.015566

PSX 0.000297 -0.000339 -0.000315 0.020497 0.014510 -0.016523 -0.015382

INTU 0.001344 -0.000275 -0.000256 0.017556 0.076529 -0.015646 -0.014565

SCHW 0.000741 -0.000345 -0.000321 0.022094 0.033535 -0.015603 -0.014525

NKE 0.000917 -0.000279 -0.000260 0.018363 0.049930 -0.015218 -0.014166

CI 0.000601 -0.000299 -0.000279 0.020070 0.029954 -0.014915 -0.013885

JPM 0.000859 -0.000250 -0.000233 0.016927 0.050736 -0.014777 -0.013756

VZ 0.000547 -0.000179 -0.000167 0.012658 0.043252 -0.014172 -0.013192

BRK-B 0.000597 -0.000175 -0.000163 0.012566 0.047487 -0.013918 -0.012956

NEM 0.001315 -0.000352 -0.000327 0.025713 0.051150 -0.013674 -0.012729

UNP 0.001055 -0.000226 -0.000210 0.016905 0.062432 -0.013351 -0.012428

DVN -0.000074 -0.000481 -0.000448 0.036368 -0.002047 -0.013223 -0.012309

GS 0.000600 -0.000247 -0.000230 0.018864 0.031815 -0.013085 -0.012181

KR 0.000147 -0.000285 -0.000265 0.021919 0.006698 -0.012992 -0.012094

TJX 0.000747 -0.000209 -0.000194 0.016821 0.044394 -0.012420 -0.011562

CMCSA 0.000689 -0.000197 -0.000183 0.016250 0.042376 -0.012102 -0.011266

BKR -0.000042 -0.000319 -0.000297 0.026913 -0.001551 -0.011844 -0.011026

CMI 0.001012 -0.000201 -0.000187 0.017724 0.057116 -0.011321 -0.010539

ROST 0.000820 -0.000191 -0.000178 0.019362 0.042330 -0.009864 -0.009182

BBY 0.001275 -0.000236 -0.000220 0.025880 0.049268 -0.009138 -0.008506

KLAC 0.001312 -0.000167 -0.000155 0.022834 0.057455 -0.007302 -0.006798

QCOM 0.001165 -0.000162 -0.000151 0.022647 0.051456 -0.007152 -0.006658

PNC 0.000588 -0.000118 -0.000110 0.017839 0.032976 -0.006599 -0.006143

HUM 0.000840 -0.000127 -0.000118 0.019460 0.043145 -0.006538 -0.006087

UNH 0.001020 -0.000092 -0.000085 0.016564 0.061564 -0.005543 -0.005160

CDNS 0.001537 -0.000082 -0.000076 0.018270 0.084126 -0.004489 -0.004178

EMR 0.000586 -0.000072 -0.000067 0.017501 0.033502 -0.004130 -0.003844

KMI 0.000072 -0.000078 -0.000073 0.021165 0.003410 -0.003692 -0.003437

CHTR 0.001047 -0.000070 -0.000065 0.019267 0.054331 -0.003643 -0.003392

TFC 0.000371 -0.000058 -0.000054 0.018971 0.019544 -0.003050 -0.002839

URI 0.000990 -0.000074 -0.000069 0.029141 0.033968 -0.002548 -0.002372

CSX 0.001088 -0.000040 -0.000037 0.018954 0.057427 -0.002122 -0.001976

MCHP 0.000967 -0.000031 -0.000028 0.023195 0.041703 -0.001317 -0.001226

CPB 0.000056 -0.000020 -0.000018 0.018044 0.003121 -0.001096 -0.001020

BAC 0.000499 0.000021 0.000019 0.020456 0.024415 0.001006 0.000936

WFC -0.000369 0.000031 0.000029 0.019072 -0.019328 0.001620 0.001508

CVX 0.000106 0.000039 0.000036 0.017311 0.006112 0.002254 0.002098

USB 0.000129 0.000049 0.000046 0.016250 0.007952 0.003009 0.002801

VMC 0.000314 0.000068 0.000064 0.020520 0.015289 0.003325 0.003096

NUE 0.000253 0.000090 0.000084 0.021610 0.011698 0.004185 0.003896

DIS 0.000336 0.000085 0.000080 0.015915 0.021101 0.005369 0.004998

DE 0.000924 0.000123 0.000115 0.019988 0.046229 0.006163 0.005737

FCX 0.000840 0.000264 0.000246 0.039415 0.021303 0.006700 0.006237

AZO 0.000205 0.000123 0.000114 0.018225 0.011264 0.006746 0.006280

TMUS 0.000878 0.000151 0.000140 0.018355 0.047845 0.008206 0.007639

TGT 0.000635 0.000209 0.000195 0.021027 0.030187 0.009961 0.009273

MS 0.000452 0.000219 0.000204 0.020587 0.021975 0.010656 0.009920

MLM 0.000316 0.000246 0.000229 0.020894 0.015123 0.011792 0.010977

ELV 0.000518 0.000239 0.000222 0.019182 0.027023 0.012459 0.011598

ORLY 0.000200 0.000260 0.000242 0.018083 0.011035 0.014351 0.013359

PH 0.000461 0.000422 0.000393 0.019399 0.023780 0.021755 0.020252

GWW -0.000023 0.000704 0.000655 0.019939 -0.001139 0.035287 0.032848

FAST -0.000236 0.001089 0.001014 0.019667 -0.012004 0.055392 0.051565

DHR 0.000442 0.000869 0.000809 0.014023 0.031545 0.061991 0.057708

====================================================================================================

GH Mixing Distribution Parameters:

p: -5.000000e-01

a: 1.912434e+00

b: 1.657275e+00